Have you ever wondered how you can afford the perfect symbol of your love without breaking the bank?

Finding the right financing options for your dream wedding rings can be daunting, but it doesn’t have to be. In this guide, we’ll explore simple and effective ways to manage the cost, ensuring you get the rings you’ve always wanted.

We’ll make it easy for you to understand the best choices for your budget and needs.

Financing Options for Wedding Rings

When considering financing options for wedding rings, there are several avenues you can explore. Here are some you should know

1. Store Financing

Many jewelry stores offer in-house financing plans to help you pay for your wedding rings over time. These plans often come with low or no interest rates if the balance is paid within a certain period. It is important to read the terms and conditions carefully to avoid unexpected fees.

Another option within store financing is a layaway plan. Layaway allows you to make regular payments until the total cost of the rings is covered. This option can be beneficial for those who prefer not to use credit cards or take out loans.

2. Personal Loans

Personal loans are another option to consider when financing wedding rings. You can apply for a personal loan through a bank, credit union, or online lender. The funds can be used to purchase your rings outright, giving you flexibility in choosing the right rings.

When selecting a personal loan, it is important to compare interest rates and repayment terms. Look for a loan with a manageable monthly payment and a reasonable interest rate. If you prefer a structured repayment plan and competitive rates, consider customer financing as offered by many jewelry stores.

3. Credit Cards

Credit cards can be a convenient way to finance your wedding rings. Many credit cards offer promotional interest rates or rewards points that can make the purchase more affordable. However, it’s essential to keep an eye on interest rates and make sure you can pay off the balance within the promotional period to avoid high-interest charges.

Using a credit card for your purchase can also help build your credit score if you make regular, on-time payments. Be aware of your credit limit to avoid maxing out your card, which can negatively affect your credit score.

4. Family Loans

Family loans can be a viable option for financing your wedding rings. These loans often come with flexible terms and little to no interest. It is essential to have a clear agreement in writing to avoid misunderstandings.

Discuss repayment terms with your family member before taking the loan. Ensure both parties have agreed on a repayment schedule. Clear communication is important to maintain a good relationship while managing the loan repayment.

5. Payment Plans

Wedding ring payment plans offered by jewelry stores can help you manage the cost of wedding rings by spreading payments over several months. These plans can be structured with fixed monthly payments that are easy to budget. Always check if there are any fees associated with the payment plan.

Some payment plans might offer interest-free terms if the balance is paid in full within a specified period. It is crucial to understand the terms and conditions to prevent any unexpected costs. Make sure you are aware of any penalties for late payments.

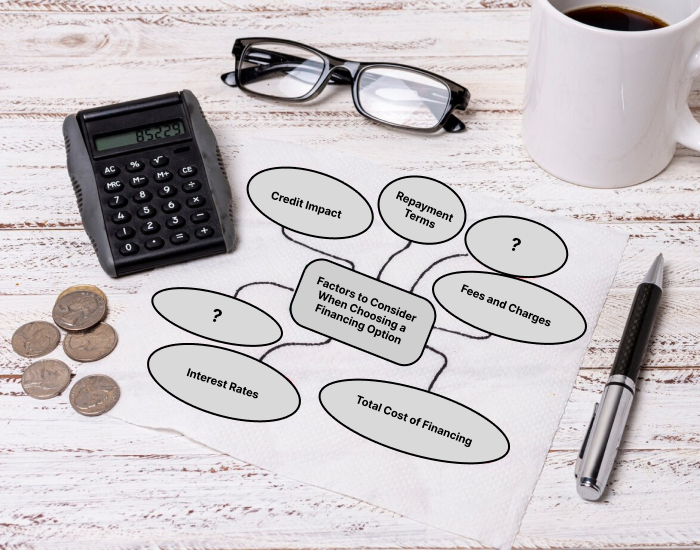

Factors to Consider When Choosing a Financing Option

When choosing a financing option, several factors should be carefully considered to ensure you make the best decision for your financial situation. Here are some you should know

Interest Rates

Interest rates play a significant role in the cost of financing your wedding rings. Higher interest rates can increase the overall amount you will pay over time. Be sure to look for financing options with the lowest possible rates to minimize your costs.

It’s important to read the terms and conditions of any financing agreement to understand how the interest rates will affect your payments. Always calculate the total cost including interest before making a decision. This will help you avoid any financial surprises down the road.

Fees and Charges

When considering financing options for your wedding rings, it’s essential to be aware of any associated fees and charges. These can include application fees, processing fees, or late payment penalties. Make sure to review all terms and conditions carefully before committing to a financing plan.

Knowing all potential fees upfront can help you make an informed decision and avoid unexpected costs. Being well-informed will enable you to choose the most cost-effective financing option for your needs.

Repayment Terms

Repayment terms are the conditions under which you will repay the borrowed amount. It is important to understand the length of the repayment period and the required monthly payment. This will help you assess whether the terms fit within your budget.

Ensure that the repayment terms are clear and manageable for your financial situation. Carefully review the agreement to avoid any misunderstandings regarding payments.

Credit Impact

Financing your wedding rings can have an impact on your credit score. Applying for new credit or taking out a loan may result in a hard inquiry, which can temporarily lower your credit score. Regular, on-time payments can positively affect your credit score over time.

It’s important to manage your credit responsibly when using financing options. Make sure you keep track of your monthly payments to maintain a good credit rating.

Total Cost of Financing

The total cost of financing includes both the principal amount and any interest accrued over the repayment period. It also encompasses any fees or charges associated with the financing option you choose. Understanding the total cost is crucial to ensuring that your selected financing option is affordable and within your budget.

Before finalizing any financing plan, calculate the total cost to avoid any surprises. This helps in making an informed decision that fits your financial situation.

Unlock the Magic of Your Dream Wedding Rings

Choosing the right financing options for your dream wedding rings can make the process smoother and more manageable. By understanding the various paths available, like store financing, personal loans, credit cards, family loans, and payment plans, you can select the best one to suit your needs and budget.

Remember to consider interest rates, fees, repayment terms, credit impact, and the total cost of financing, ensuring you can enjoy your rings without financial stress

We hope you found this article helpful. If you did, be sure to check out our blog for more great content like this.